Initially royalty payments were not taxed but beginning Nov 30, 2020 according to the IRS law in the United States the client must submit their fiscal id which is the same as a tax id or EIN info for reasons of tax filing at the end of each calendar year which also the information will be verified before any full payments shall be made to the client. If a client refuses to submit their tax id/Ein information at such time MediaFamous.com in compliance with tax laws shall withhold the correct amount of tax deductions from the clients payment and include such withholding information in their payment receipts. For international clients there is a tax withholding up to 30% accordingly to U.S. Tax Law. The tax forms necessary must still be filled out to be submitted to the IRS and you can find out if your country has a tax treaty with the U.S. which would allow MediaFamous.com to not collect those taxes and distribute your payment entirely. We encourage our international clients to find out your VAT tax rate so you better understand this term or to find out if your country has a Tax Treaty in place with the U.S so there will be no withholdings.Here Is What MediaFamous.com Wants Their Clients To Know Regarding Tax Information.

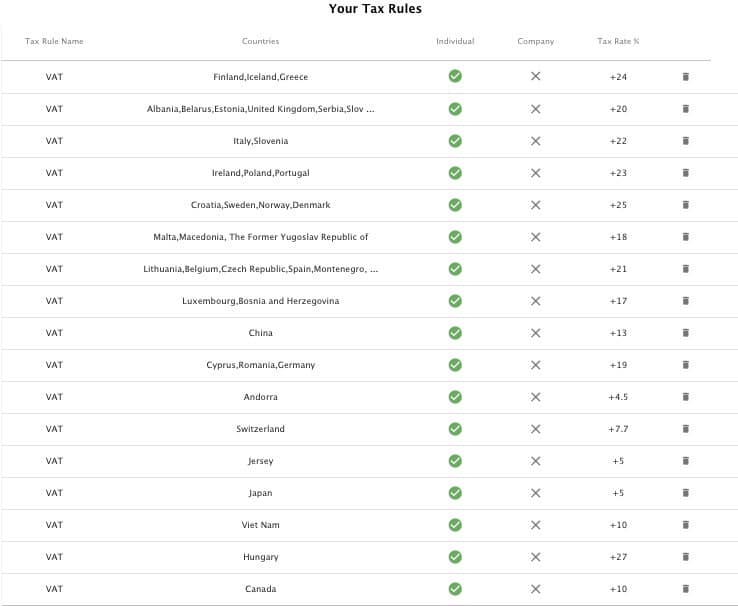

Please Refer To The VAT Tax Rate Table for your country tax rate that will be deducted from out payments if you do not live in the United States.